Georgia payroll tax calculator

For 2022 the minimum wage in Georgia is 725 per hour. Paycheck Results is your gross pay and specific.

Free Corporation Tax Filing With Accounting Package Available At Abacconsulting Taxation Tax Accounting Account Filing Taxes Income Tax Income Tax Return

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

. Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. So the tax year 2022 will start from July 01 2021 to June 30 2022. This guide is used to explain the guidelines for Withholding Taxes.

Georgia tax year runs from July 01 the year before to June 30 the current year. Georgia Hourly Paycheck Calculator. Free Unbiased Reviews Top Picks.

Ad Payroll So Easy You Can Set It Up Run It Yourself. In 2022 the Georgia state unemployment insurance SUI tax rate will sit at 27 for new businesses with the maximum taxable wage base set at 9500. 2022 Employers Tax Guidepdf 155 MB 2021 Employers Tax Guidepdf 178 MB.

Georgia Hourly Paycheck Calculator Results. Employers also have to pay a matching 62 tax up to the wage limit. Get Started With ADP Payroll.

Medicare tax which is 145 of each employees taxable wages up to 200000 for the year. After a few seconds you will be provided with a full breakdown. Free Unbiased Reviews Top Picks.

Ad Compare This Years Top 5 Free Payroll Software. Calculating your Georgia state. Georgia Salary Paycheck Calculator.

The results are broken up into three sections. The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

All Services Backed by Tax Guarantee. Use the Georgia paycheck calculators to see the taxes on your paycheck. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Georgia Paycheck Calculator 2022 - 2023.

This includes tax withheld from. Below are your Georgia salary paycheck results. Just enter the wages tax withholdings and other information required.

The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Georgia Payroll Tax Rates. To use our Georgia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Get Started With ADP Payroll. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. You wont be alone in.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Compare This Years Top 5 Free Payroll Software. Ad Process Payroll Faster Easier With ADP Payroll.

The Peach States beer tax of 101 per gallon of beer is one of the highest nationally. Georgia has among the highest taxes on alcoholic beverages in the country. Ad Process Payroll Faster Easier With ADP Payroll.

Select your current state from the checklist below to find out the hourly paycheck loan calculator. Calculate Your Georgia Net Pay Out Or Take Home Pay By Coming Into Your Per. Register as an employer on the Georgia Employment.

The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay.

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Paycheck Calculator Take Home Pay Calculator

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

Georgia Paycheck Calculator Smartasset

Georgia Sales Reverse Sales Tax Calculator Dremploye

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Us Tax Calculator 2022 Us Salary Calculator 2022 Icalcul

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

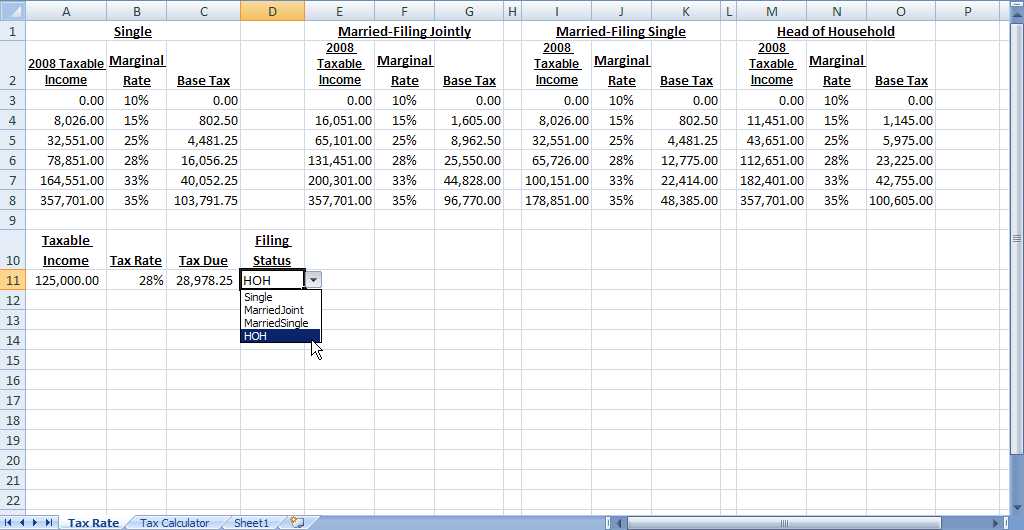

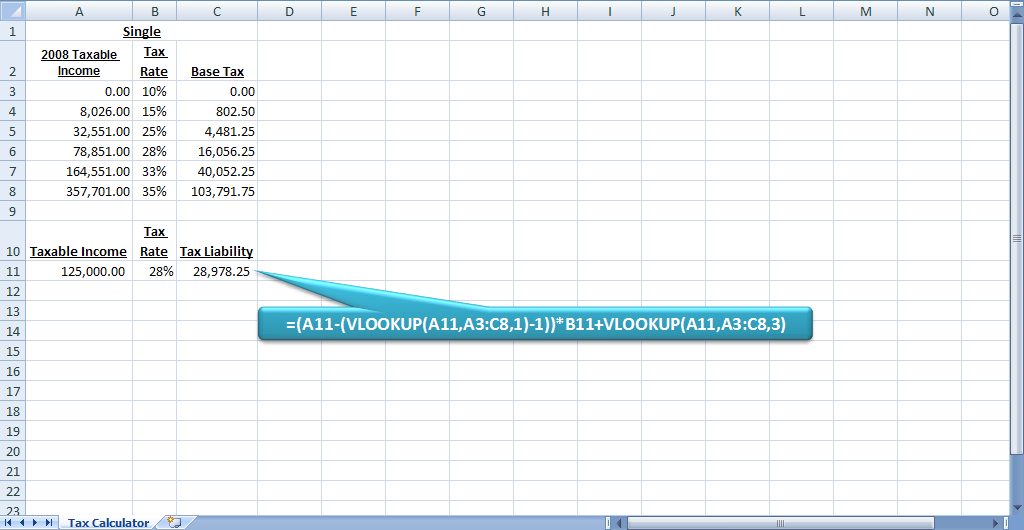

Build A Dynamic Income Tax Calculator Part 2 Of 2 Davidringstrom Com

Payroll Tax Calculator For Employers Gusto

Paycheck Calculator Take Home Pay Calculator

Employer Payroll Tax Calculator Incfile Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Payroll Taxes Methods Examples More

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

W12 Tax Form Example Is W12 Tax Form Example Still Relevant Tax Forms W2 Forms Filing Taxes

Free Employer Payroll Calculator And 2022 Tax Rates Onpay